|

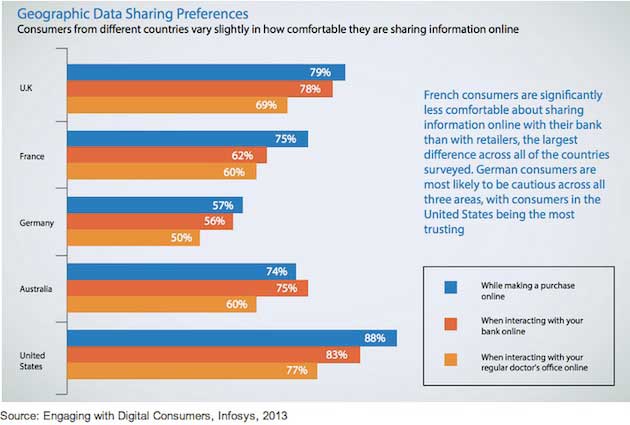

Consumers worldwide overwhelmingly say they will share personal information to get better service from their doctors, banks, and retailers, according to a recent report from Infosys. However, they are very discerning about what they share, and they are sometimes skeptical about how institutions use their data. Americans, Europeans, and Australians feel comfortable sharing data with doctors (90%), banks (76%), and retailers (70%)with caveats. Consumers wont readily share personal medical history with doctors, and they say they want targeted ads from retailers but they are wary of sharing the information to enable such targeting. Below, key findings from the report, which was based on a poll of 5,000 digitally savvy consumers in five countries (Australia, France, Germany, the US, and the UK) about how they share personal data in the retail, banking, and healthcare sectors. Data Mining Consumers understand the benefits of sharing data but remain cautious of data miningespecially European consumers. 39% globally describe data mining as invasive while also saying it is helpful (35%), convenient (32%), and time-saving (33%). Consumers in the United States are less concerned about the invasive issue (30%) compared with the other countries surveyed. German consumers are less willing to share personal data compared with those in the other countries surveyed.

Findings by Industry Retail Three-quarters of consumers worldwide say retailers currently miss the mark in targeting them with ads on mobile apps, and 72% do not feel that online promotions or emails they receive resonate with their personal interests and needs. 78% of consumers agree that they would be more likely to purchase from a retailer again if the retailer provided offers targeted to their interests, wants, or needs, and 71% feel similarly if offered incentives based on location. Though in principle shoppers say they want to receive ads or promotions targeted to their interests, just 16% say they would share social media profile information.

Banking 82% of respondents expect their bank to mine personal data to protect against fraud. 76% of consumers would consider changing banks if a competitor offered assurances that their data and money would be safer. 63% of consumers want banks to communicate with them about their account or transaction information via alerts to their mobile devices; however, only 32% frequently share information on these devices. 35% of consumers still feel that their current bank or financial institution does not have a clear process for addressing fraud-related issues.

Healthcare 88% of consumers favor physicians' being armed with electronic health information about patients. However, only 56% would share personal medical history with their doctor's office in order to get a more personalized experience. 76% are interested in mobile apps for tracking their health. Consumers prefer to share personal data with their doctor's office in person (98%), followed by online (77%) and mobile (66%).

For more findings from the study, check out the following infographic: SOURCE: http://bit.ly/18tGymO, this factual content has not been modified from the source. This content is syndicated news that can be used for your research, and we hope that it can help your productivity. This content is strictly for educational purposes and is not made for any kind of commercial purposes of this blog. |

|